child tax credit payment schedule for november 2021

29 What happens with the child tax credit payments after December. By making the Child Tax Credit fully refundable low- income households will be.

Child Tax Credit Update Next Payment Coming On November 15 Marca

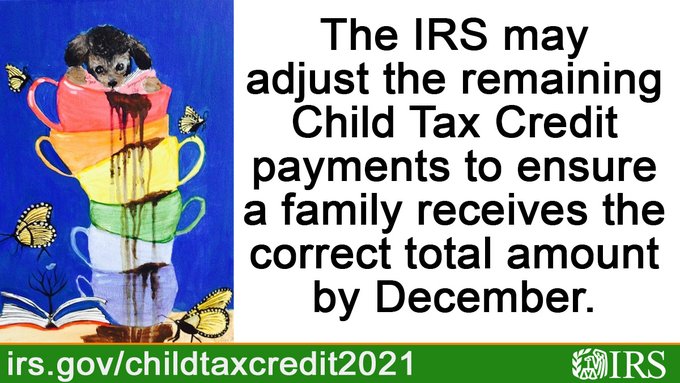

However for some families the.

. Families who sign up will receive half of their total Child Tax Credit on December 151800 for each child under 6 and up to 1500 for each. From January to December 2022 taxpayers will continue to receive the advanced child tax credit payments as usual. Up to 3000 for each qualifying child age 6 to 17.

Related services and information. The credit amount was increased for 2021. The advance is 50 of your child tax credit with the rest claimed on next years return.

IR-2021-222 November 12 2021. The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for other qualifying children under age 18. Do not call the IRS.

While another stimulus check. November 25 2022 Havent received your payment. Families who are eligible but havent signed up could receive the amount of all the advance payments as one lump sum if they opt-in for the final payment of.

For each child under age 6 and. 15 opt out by Aug. Advance payments will continue next month thanks to the American Rescue Plan passed back in March of 2021.

Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month. The remaining 1800 will be. Payments begin July 15 and will be sent monthly through December 15 without any further action required.

Low-income families who are not getting payments and have not filed a tax return can still get one but they. There have been important changes to the Child Tax Credit that will help many families receive advance payments. November 24 2021 Getty Images The next batch of child tax credit payments is scheduled for December 15.

3600 for children ages 5 and under at the end of 2021. Payments start July 15 2021. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 through 17 for 2021.

Here is some important information to understand about this years. Up to 300 per month. Up to 300 dollars or 250 dollars depending on age.

For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. If you dont typically file a tax return and you are not already receiving Advance Child Tax Credit payments you can still register for your advanced monthly payments through the IRS Non-filer Sign Up Tool until November 15 2021. So parents of a child under six receive 300 per month and parents of a child six or over receive 250 per.

The stimulus check part of President Joe Bidens child tax credit plan will see those who meet the final November 15 deadline potentially receive up to 1800 per child come December. You will receive either 250 or 300 depending on the age of. The opt-out date is on November 1 so if you think it may be.

Wait 5 working days from the payment date to contact us. The American Rescue Plan Act ARPA of 2021 expands the Child Tax Credit CTC for tax year 2021 only. The credit was made fully refundable.

Eligible families can receive advance payments of. 15 opt out by Oct. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families will soon receive their advance Child Tax Credit CTC payment for the month of November.

Half of the total is being paid as six monthly payments and half as a 2021 tax credit. Four payments have been sent so far. Child Tax Credit Payment Schedule for 2021.

The complete 2021 child tax credit payments schedule. Wait 10 working days from the payment date to contact us. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates.

Schedule of 2021 Monthly Child Tax Credit Payments. This months payment will got out on Monday November 15. Benefit and credit payment dates reminders.

The credit amount isnt changed so the monthly payments remain the same. The complete 2021 child tax credit payments schedule. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids who are 5 years old or younger and 3000 per child for kids 6 to.

For each child age 6 and above. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. 3000 for children ages 6 through 17 at the end of 2021.

Ad The new advance Child Tax Credit is based on your previously filed tax return. Benefit and credit payment dates reminders. Your recurring monthly payments shouldve hit your bank account on the 15th of each month through December.

By August 2 for the August. Below is the full Child Tax Credit payment schedule for the rest of this year as outlined by the IRS. The 500 nonrefundable Credit for Other Dependents amount has not changed.

15 opt out by Nov. The advanced Child Tax Credit payments are due out on the 15th day of each month over the second half of 2021 meaning that November 15. Up to 300 dollars or 250 dollars depending on age of child.

Up to 250 per month. 15 opt out by Nov. The Child Tax Credit provides money to support American families.

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. July August September and October with the next due in just under a week on November 15. Alberta child and family benefit ACFB All payment dates.

2021 Advance Child Tax Credit. Below are frequently asked questions about the Advance Child Tax Credit Payments in 2021 separated by topic. 15 opt out by Nov.

13 opt out by Aug.

Fy 2020 21 Ay 2021 22 Itr Forms For Salaried Individuals Other Income Sources Which Itr Form To Download File Itr Online Tax Filing System Filing Taxes Indirect Tax

Primary School Certificate Somaponi Exam Routine 2021 School Certificates Exam Primary Education

Coronavirus And Your Money Kiplinger

10 Sponsorship Letter Samples Word Excel Pdf Templates Sponsorship Letter Letter Templates Free Letter Example

Some Families Will Get 900 Per Child In Child Tax Credits This Month See If You Re Eligible

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

The Oklahoma State Building And Construction Trades Council Is Hosting Its Fifth Annual Apprenticeship Open House On N Apprenticeship Building Trade Open House

Ski And Snowboard At Sun Peaks Ski Trip Ski Packages Ski And Snowboard

Child Tax Credit Delayed How To Track Your November Payment Marca

Irs Gives Taxpayers One Day To Rightsize Child Tax Credit November Payments November 1

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

2 Twitter Gop Proposal Health Care

Child Tax Credit Delayed How To Track Your November Payment Marca

7 Nights Maldives To Mumbai On Costa Victoria Nov 2019 Feb 2020 Costa Victoria Maldives Cruise Packages

Child Tax Credit 2021 8 Things You Need To Know District Capital

Some Families Will Get 900 Per Child In Child Tax Credits This Month See If You Re Eligible